The Great Reset in the U.S. Drone Industry

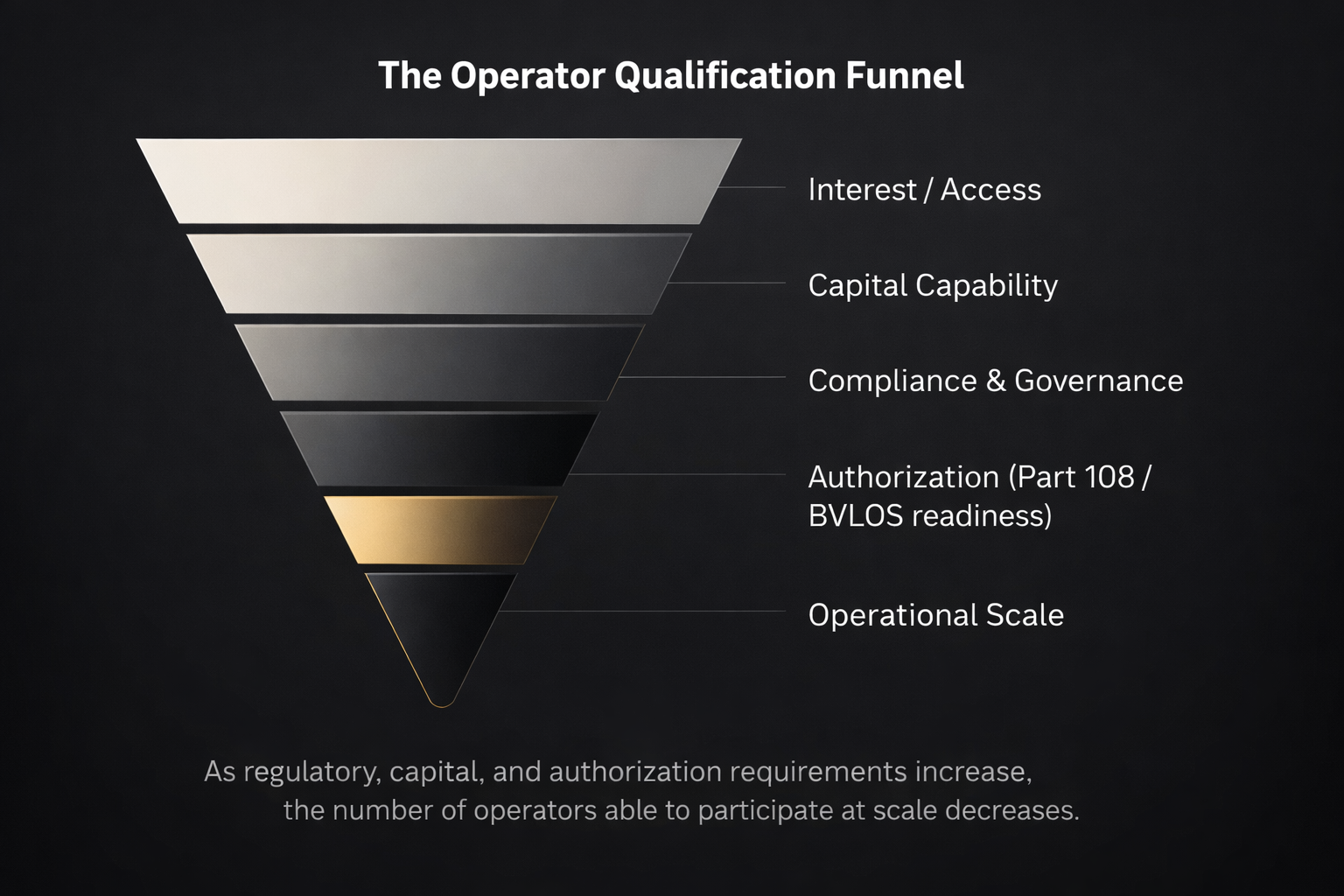

An industry in transition, moving from broad access to selective capability as regulation, scale, and authorization reshape who can operate.

By Kevin Padilla

The U.S. drone industry is about to shift dramatically, potentially for the better, but not without significant disruption first.

For those who are not immersed in the drone industry, December 23, 2025 marked a significant inflection point. On that date, DJI was officially added to the Covered List, signaling what may be the beginning of the end for the world’s most dominant drone manufacturer in the U.S. market. Some reports estimate that DJI held as much as 75 percent of the U.S. market and that the United States accounted for roughly 30 percent of the company’s total revenue. The impact of that decision alone represents a seismic shift for the industry.

If that shockwave was not enough to unsettle operators, manufacturers, and distributors alike, the next one approaching may prove even more consequential. The FAA’s trajectory toward Part 108 fundamentally changes who can participate in the drone industry at scale. This is no longer a debate about whether drones are useful. That question has already been answered. The defining issue going forward is who can legally, reliably, and credibly deliver those capabilities within a far more regulated operating environment.

As requirements increases.

Participation narrows.

Over the last decade, the industry expanded rapidly, in many cases exponentially. That growth was not inherently bad; in fact, it’s been incredible to see. DJI’s low barrier to entry played a critical role in accelerating adoption, normalizing drones as legitimate tools across industries, and enabling an unprecedented level of efficiency. That accessibility was a net positive for the market and for innovation.

The challenge now is not that those barriers once existed, but that they are rising. Many operators built businesses around an environment defined by affordability, simplicity, and rapid scalability. All industries are shifting toward higher capital requirements, tighter regulation, and more complex operational expectations. Frankly, I don’t believe a significant portion of the market may be prepared to adjust. The question is no longer who can fly a drone, but who has the capacity, financial, operational, and organizational, to adapt to what comes next, especially after having invested heavily in platforms and workflows that may no longer be viable.

DJI’s ecosystem itself was exceptional. Hardware, software, and workflow were tightly integrated in a way no competitor has fully replicated. That efficiency became the industry baseline. Businesses were built around a system that was fast, reliable, and forgiving. As access to that system becomes restricted, the adjustment will be difficult. Operators are not just losing a platform; they are losing a workflow, a reliability assumption, and an expectation of simplicity. Many will struggle to adapt to a fragmented ecosystem with higher costs and steeper learning curves.

This isn’t a collapse.

It’s a filter.

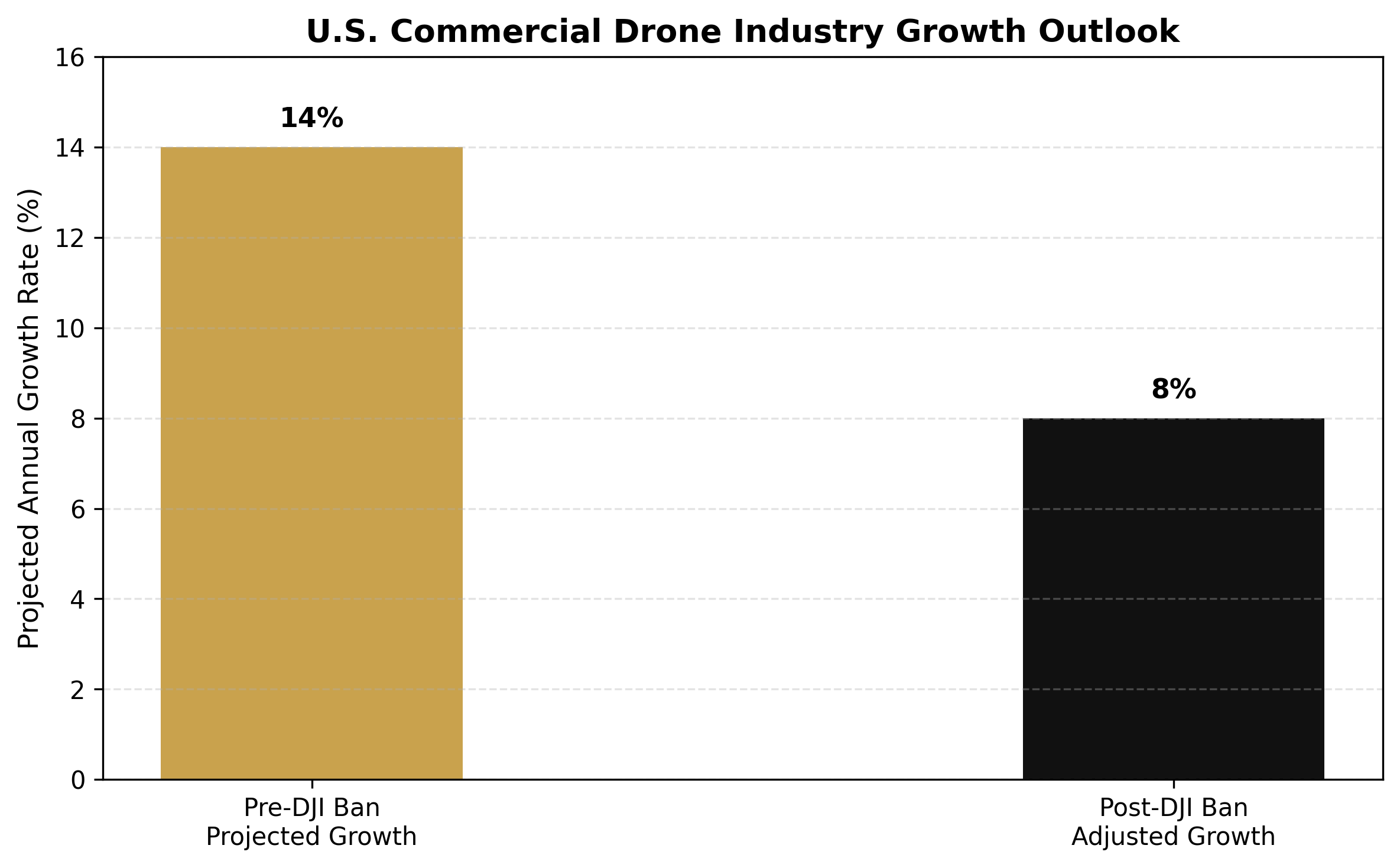

Before these changes, most projections placed U.S. commercial drone growth in the 13% - 15% annual range, with total market value approaching $35-$40 billion by the end of the decade. Those forecasts assumed continued access to low-cost hardware, rapid onboarding of small operators, and incremental expansion of BVLOS through waivers. That growth path has been interrupted. Current projections suggest near-term growth closer to 7%-9%, effectively cutting the slope of the curve in half.

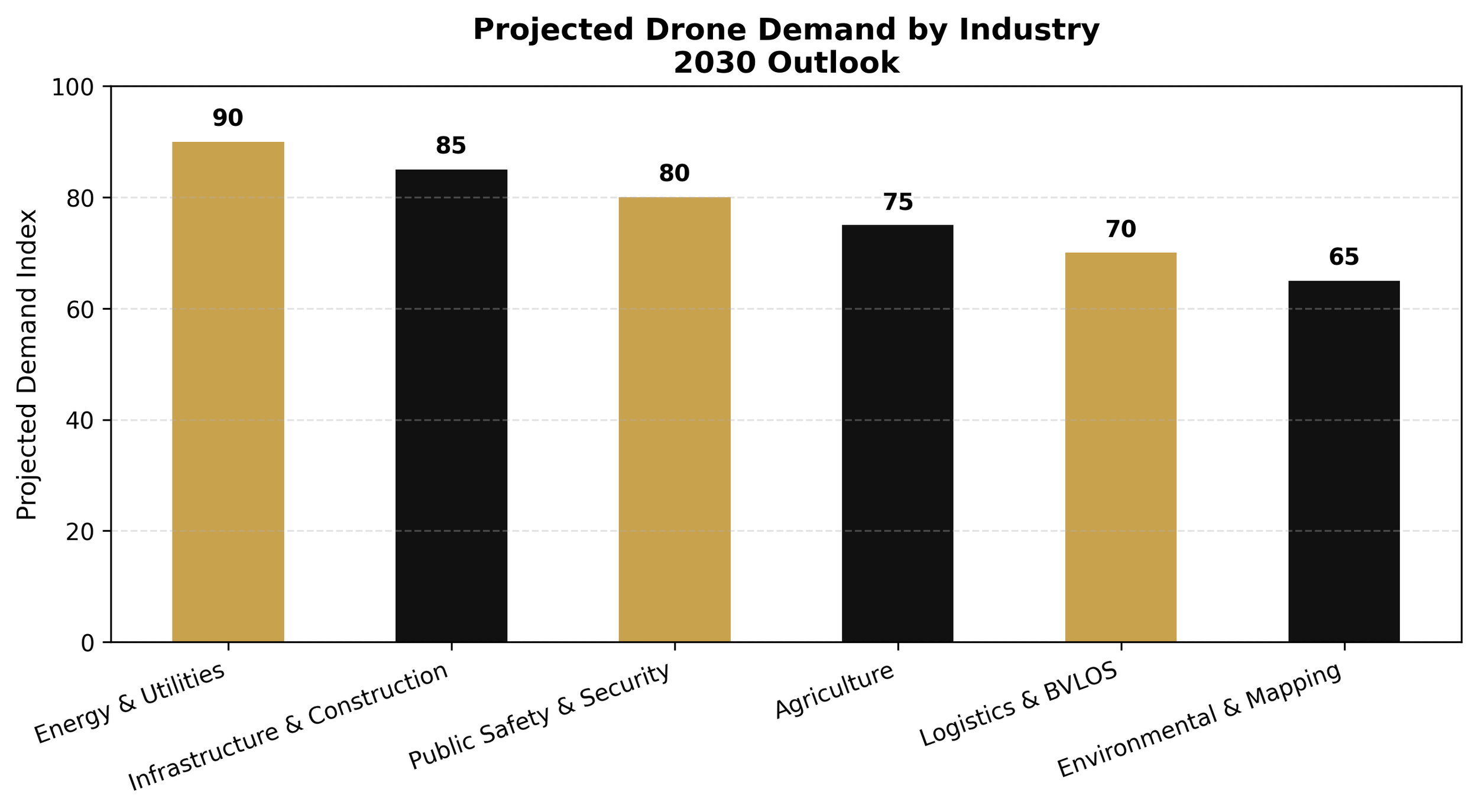

Demand persists across sectors.

This isn’t as bad as we think. Looking at it. The slowdown is meaningful, but it does not reflect a loss of demand. It’s reflective of the supply. The coming part 108 will significantly reduce who will be able to do what. Waivers are going away. Access to BVLOS and operating around this is where most drone operators will make their income. Without the ability to do that, growth will remain low or very niche. This reduction in supply is what flattens growth projections, not a disappearance of customer need. Energy, infrastructure, construction, agriculture, and security demands remain strong, and in many cases are increasing.

Fewer competitors and higher barriers to entry tend to produce higher contract values, longer engagements, and more durable revenue. The market shifts away from transactional flights toward permission-based programs.

From my perspective, this transition was inevitable. The next phase of the industry will not reward speed or convenience. It will reward preparedness, discipline, and the ability to operate when authorization, not capability, becomes the limiting factor. Growth may look slower on paper, but for those positioned to adapt, there is still money to be made. This is not the end of the drone industry. It is the point where it starts behaving like one.

Above. It. All